Become A Partner

Drive Sales Growth With Financing Options For all Customer Profiles

The Easy Way to Offer Your Customers Finance Options Direct From Your Business and Website

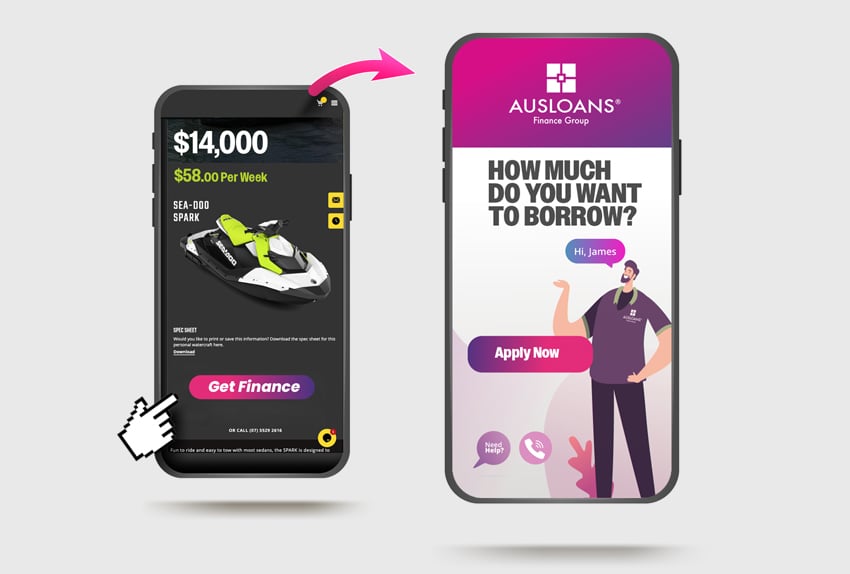

Fast, Self Serve Finance Options at The Point of Sale.

Unlock infinite financed sales potential with QR code activated marketing collateral that promotes affordability and empowers your customers to self serve anywhere, any time.

Transform Your Website into a Lead Generation and Sales Powerhouse

Implementation is seamless and it takes less than a day. Your company can offer the same transparent quoting tools and matching technology embedded natively on your website!

Simple Activation in Under 24 Hours

Implementation is seamless and it takes less than a day. Your company can offer the same transparent quoting tools and matching technology embedded natively on your website!

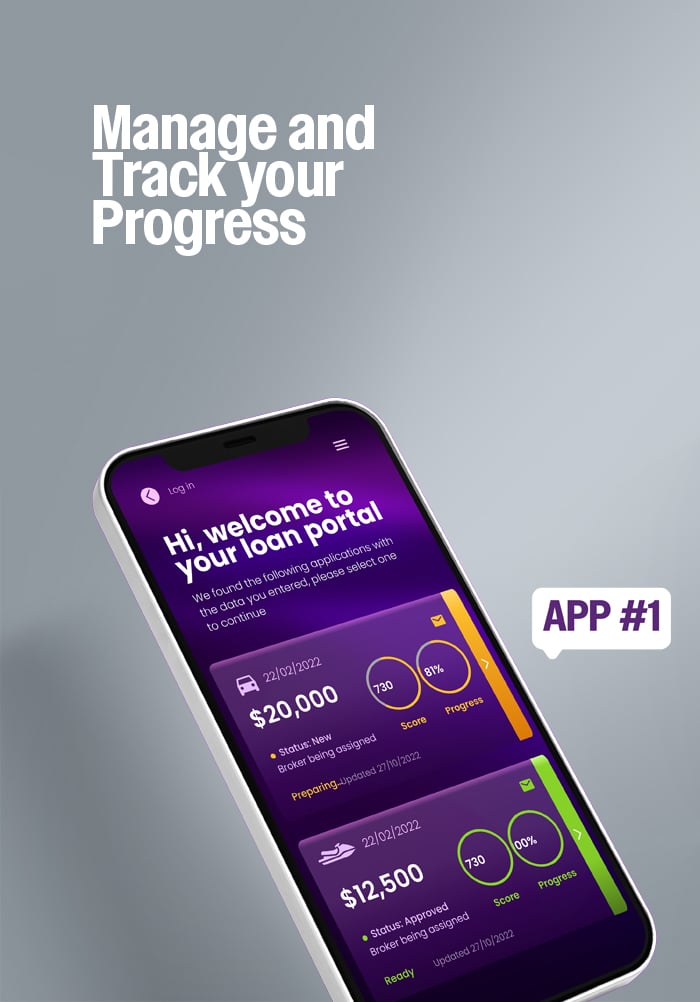

A Seamless Experience For You and Your Customers

Unlock the power of our AI technology to deliver loan options your customers will love. Our extensive lender panel provides financing solutions for a wide range of consumer and business credit needs helping you maximise sales.

For You

Expand your customer financing options, maximise sales, increase revenue and fuel growth with our advanced financing fintech and business growth stack.

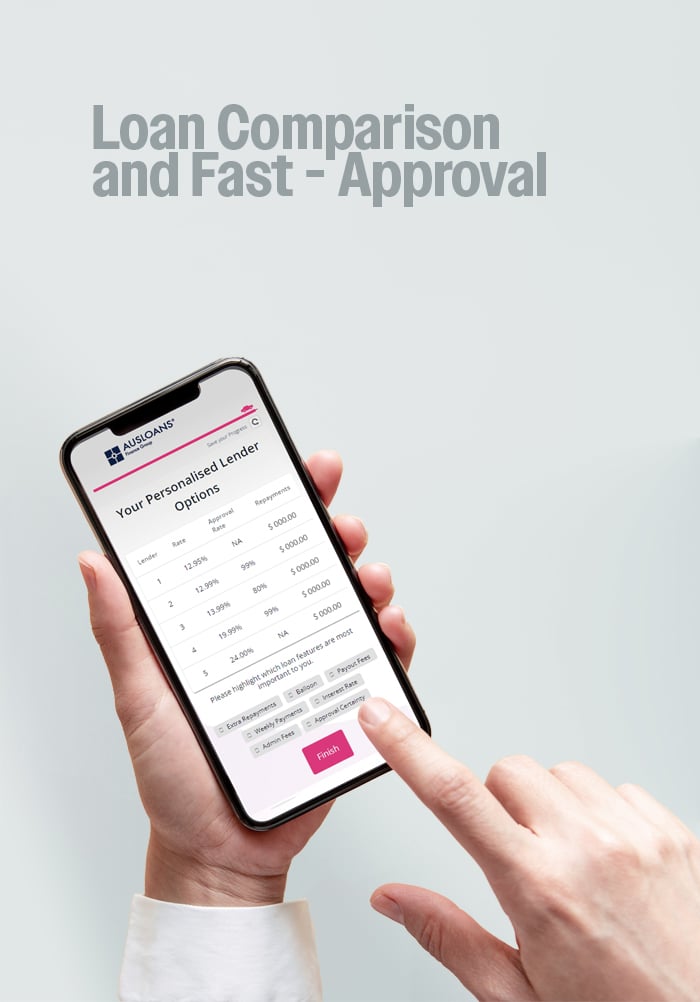

Your Customers

Deliver an exceptional customer experience with fast, self serve finance, instant loan comparison and pre-approval.

Best For Goods and Services Over $7500

Ausloans Zink is designed to help any business that needs to offer their clients finance options

Auto Dealers

Click here to explore our dealer solutions

Motorbikes

Including electric motorcycles

Caravans

Caravans Campers and Trailers

Marine

Boats and Jet Skis

Earthmoving

earthmoving machinery & equipment

Home Improvement

Roofing, patios, pergolas nd more

Coaching

big ticket coaching programs

Equipment Vendors

Including machinery, plant and equipment

Retailers

For all big ticket retail goods over $7500

Solar

Solar systems, Batteries and more

Medical & Dental

equipment, surgery and cosmetic procedures

Accountants

Expand your service offerings with loan options

Why we love Ausloans Finance

Read what our partners say about us.