9 Useful Tips To Sell More Cars At A Dealership

by Chris Hopkins, on Jan 7, 2021 12:43:26 PM

Dealerships that actively promote finance sell more, but is your dealership maximising the financed sales opportunity?

According to consumer research conducted by carsales.com.au, there has been a significant shift in the way consumers engage with car finance in their journey to purchasing a new car.

The Carsales study, conducted in October 2020, sheds light on how car dealers and Financial Service providers (FSPs) can improve car finance engagement with consumers.

In todays post we explore the changing trends in consumer car buying behavior outlined in the Carsales consumer research and share x simple things that your dealership can do to align your sales process to match the needs of your customers.

So lets get started.

How Consumer Engagement With Car Finance Has Shifted

We are all acutely aware that traditional consumer retail purchasing behaviour has been heavily disrupted by the Covid pandemic, but are you aware that this disruption has also heavily impacted the way in which consumers are now shopping for big ticket items like cars?

According to the recently published consumer research report by Australia's biggest online car retailer, carsales.com.au, consumer behavior with regards to buying cars and accessing finance has shifted dramatically.

Here's the key findings from the Carsales consumer behavior study.

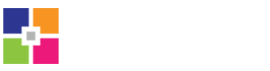

1. Consumers are researching finance longer

In a significant shift in buyer behavior, car buyers are carrying out a lot more research to understand the pros and cons of different finance solutions, determine their spending plans and also analyze finance eligibility requirements.

According to the Carsales report

Surveyed consumers that purchased cars within the past year were 12x more likely to spend three months or more researching their finance options, compared to surveyed consumers that purchased between 12–24 months ago. Consumers are choosing their finance solution earlier

Significantly, this trend is being driven largely by consumers in the 30 -54 years age bracket with 18% of car buyers who have an average income of between $80 00 - $180 000 choosing to research finance options more than one month out from their car purchase.

One of the biggest findings of the Carsales research is the time frame for organising car finance. The data indicates that not only are consumers researching finance options earlier, they are also choosing their preferred finance provider much earlier in the buying journey

According to Carsales data 27% of car buyers organise their car finance 3 months before actually purchasing with the likelihood of consumers organising finance increasing to 41% 2 months before purchase and 61% for those ready to buy within one month.

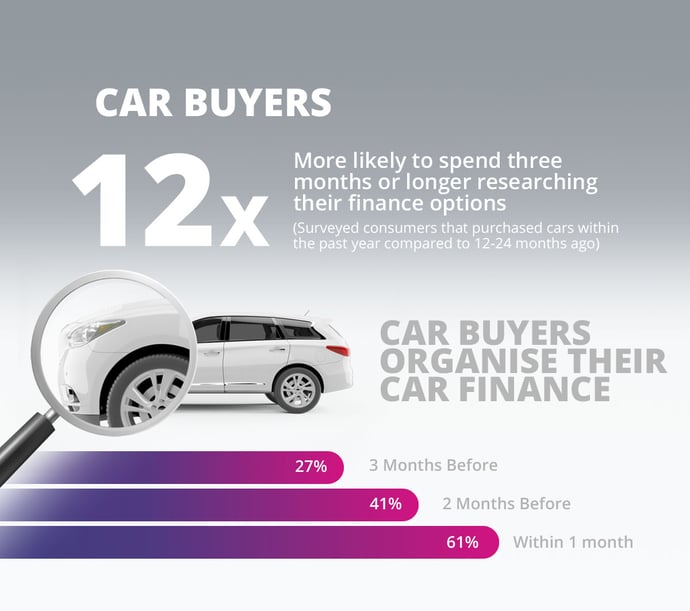

3. Weekly repayment estimates make assessing finance options easier

For many people understanding the fine details of finance is at best difficult and at worst confusing. Breaking down finance options into weekly payments provides both transparency of consumer cost and simplicity of understanding the cost.

62% of surveyed consumers said breaking down the cost of finance into weekly repayment estimates would help them rationalise their car purchase.- Carsales

More importantly, 67% of surveyed car buyers indicated that weekly repayment estimates help them better understand vehicle affordability.

4. Convenience is the #1 driver of consumer finance decisions.

According to Carsales consumers perceive organising vehicle finance to be a complicated process. In fact they say that 45% of all consumers surveyed cited convenience as the single biggest deciding factor in their finance decisions.

Further, convenience topped value for money on 39% and lowest repayments on 29% as a key factor in their finance decision making.

so what do these changes in consumer car finance shopping mean for auto dealership finance marketing?

Key Takeaways For Car Dealers and Financial Service Providers

There are 4 key takeaways for dealerships looking to increase finance penetration and in this section we will highlight exactly what they are and provide some guidance as to what dealerships can do to align their marketing and sales processes to match this shift in buyer behavior. So lets dive in.

1. Increase finance visibility across your website.

With consumers conducting finance research up to 3 months prior to purchasing a vehicle it pays to maximise finance visibility across your website. Here are x simple things you can do to increase finance visibility.

Include a finance banner on your homepage slider.

,Your website homepage is prime real estate and the content above the fold (the content a visitor can see on your page before scrolling down) is the most valuable.

/Ausloans%20blog%20images%20(2020)/fast%20easy%20finance%20hero%20banner.png?width=1200&name=fast%20easy%20finance%20hero%20banner.png)

Our recommendation is to include your finance banner above the fold to ensure maximum visibility. If your website contains a homepage slider be sure to dedicate at least one banner in your slider to promoting your finance solution. Ideally make sure you place this banner within the first 3 images in your slider as this maximises the opportunity for it to be seen before visitors scroll down the page or click on a navigation link.

A further consideration is your finance banner design. Make sure your finance banner includes two CTA's (Call to action buttons). Button one should be a learn more button that links to a finance explainer page that provides more detail about your finance solution and how to apply. Button two should be an apply now button that links directly to your finance application or enquiry form.

Add a finance link to your website header and footer navigation menus

![]()

One of the biggest mistakes I see on dealership websites is the absence of clearly visible top level finance navigation links. By placing a link to your finance information page and application or enquiry form in your top level site navigation menu you make the fact that you offer finance clearly visible and easily accessible. The bottom line, the more visible your link the higher the click through rate.

Add finance links and/or CTA banners to your vehicle pages

Strategically placing finance promotional banners, buttons and anchor text links to your finance offering on all of your vehicle pages greatly enhances the probability of consumer engagement. Your goal is to make finance highly visible across your site.

/Ausloans%20blog%20images%20(2020)/car%20sales%20finance%20sidebar%20banner.png?width=600&name=car%20sales%20finance%20sidebar%20banner.png)

2. Increase consumer education with regard to asset finance

Dealers and financial service providers must increase awareness and consideration of their finance offers earlier in the car-buying journey, but how do you do this?

The simple answer, attract prospective customers at all stages of their financing journey by publishing educational content that aligns with each stage of the car buyers journey.

/Ausloans%20blog%20images%20(2020)/car%20buyers%20finance%20journey.png?width=1200&name=car%20buyers%20finance%20journey.png)

The earlier in the buyers journey you can attract and engage with the customer the higher the probability of your dealership closing the deal on both the sale of a vehicle and the sale of finance.

By publishing educational content to your blog and then sharing the content links to your social media channels you can not only attract more visitors to your dealership website, but also drive deeper consumer engagement with your car financing solution.

So what types of content are appropriate to attract prospects at each stage of the buyers journey? Below are a few examples of the types of content that consumers are searching for.

| Car Finance Journey Stage | Blog Content Ideas |

| Awareness Stage The | best way to finance a car |

| Consideration Stage | 4 types of car finance - which is best for you |

| Decision Stage | How to compare lender car finance rates |

Hot Tip: When publishing educational blog content always include a finance CTA banner that links to your finance application page and / or loan repayment calculator. Below is an example of a simple CTA banner used by our partners.

3. Start promoting finance with weekly payment estimates

Advertising vehicles using weekly repayment estimates removes sticker shock and has the power to increase perceived affordability. The bottom line, displaying vehicle prices in terms of weekly repayment estimates helps buyers rationalise affordability and can lead to exploration of vehicle options across a wider range of price points.

Carsales.com.au understands the power of displaying weekly financed payment estimates and recently released a new Finance Extension that displays financing estimates. When consumers look at a vehicle in more detail, they are presented with a clear and convenient weekly repayment estimate.

Hot tip: Add a car finance calculator to your website. This will allow your customers to explore payment options and determine potential payment plans that fit with their lifestyle and budget.

Here's an example of the Ausloans finance repayment calculator that is built into our partner pages.

/Ausloans%20blog%20images%20(2020)/car%20loan%20repayment%20calculator-1.png?width=600&name=car%20loan%20repayment%20calculator-1.png)

4. Increase consumer financing convenience

It's one thing to attract potential customers with attractive weekly repayment estimates but what really fast tracks sales is providing customers with instant gratification of their desire and ability to qualify for finance.

With Ausloans Zink for dealerships, we make offering and delivering fast finance a reality. With Zink dealerships can offer clients self service access to finance directly from their website. Alternatively dealership administrators can quickly assess customer eligibility for finance in under 5 minutes at the point of sale and if approved, match the customers with the best lender and rate for their circumstances.

Dealerships can also use our built in car finance calculator to quickly and easily create and package vehicle pricing into weekly repayment estimates.

The Wrap up

On the back of the massive disruption to the traditional car buyers journey brought about largely by Covid 19, consumer car buyer behavior has changed and may never return to the good old days. Understanding this, the pressure is now on dealerships to become more agile. In 2021 a dealerships ability to pivot marketing and sales tactics to align with changing consumer behavior will be the key to success.

At Ausloans we are committed to supporting auto dealerships and offer a suite of software and sales enablement tools to help you maximise finance penetration in 2021 and beyond.

/Ausloans%20blog%20images%20(2020)/car%20finance%20available%20CTA%20banner.png?width=600&name=car%20finance%20available%20CTA%20banner.png)