Consumer Financing - Why Should Your Business Offer Financing to Customers?

by Chris Hopkins, on May 27, 2020 1:44:04 PM

If you're business is not offering customer finance you're probably losing business to a competitor who does. Offering free access to finance is a powerful business generating tool that can help your business increase sales, but increased sales aren't the only benefit of providing customers with finance solutions.

In this post we explore the question of why your business should offer finance. We look at the key benefits, to both your business and your customers, of adding finance options to your sales tools and show you how Ausloans consumer finance solutions for businesses can help you accelerate your business growth. So lets get started.

What is consumer financing?

Consumer financing is a customer facing service a businesses provides which allows the customer to make regular, low monthly payments toward the cost of a big-ticket item, instead of paying the full price up front.

For example a local Jet Ski shop may sell a jet ski for $10 000 but rather than promoting the sales price they could advertise something like this.

What is a consumer financing program?

A consumer financing program is a business to business service which allows businesses to partner with a professional finance company to offer consumer financing services.

At Ausloans we provide a range of customer financing programs to suit the needs of big ticket sellers no matter the size of your business. but first...

Why you should offer consumer financing to customers

Regardless of your business size, your business can benefit from offering consumer finance.

Numerous studies show businesses who offer and actively promote consumer financing sell more. In fact, a recent study by Forrester showed that companies who implemented an online, point-of-sale financing option saw a 32% increase in sales.

Offering finance solutions for your customers is going to allow you to sell more and sell more efficiently. Statistically speaking you could be selling 20% to 30% more by incorporating sales financing into your sales process.

Consumer financing program benefits for business

Here's our list of the benefits your business can expect from offering customer finance.

Consumer financing helps sell more

As already stated, there are many benefits, to both your business and your customers of offering finance. However probably the most significant is that offering finance removes the biggest restraint to closing the deal, customer budget.

The simple truth is every customer has a budget, a constraint based on the availability of the money, they have today, to purchase your product or service.

Offering financing gives you the power to redirect the sales conversation away from the constraints of budget to the benefit of your product or service.

How? By introducing the idea of a monthly or weekly payment plan and by not talking about the overall product or service cost upfront, you can eliminate the sting of sticker shock. Put simply, instead of talking price you can show customers how low monthly payments can allow them to buy exactly what they want, today.

Consumer financing makes up-selling is easier

The goal of every professional sales person is to help customers achieve their purchasing goal. So, when it comes to assisting customers with purchasing, offering customer finance solutions can deliver significant rewards for your business.

We already know that financing increases a customer’s purchasing power, making consumer access to big ticket items and your ability to close sales easier. However, it's also a powerful tool for up-selling. With access to finance consumers purchase more.

According to an article by e-commerce platform giant, Big Commerce the average sales transaction size increases by 15% when customers have access to point-of-sale finance.

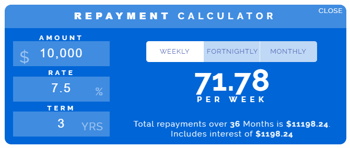

So how might this work for your business. Let's take the example of an excited buyer in a local jet ski shop. The jet ski salesman already knows that jet ski finance is available at an interest rate of 7.5%

The customers dream is to purchase a new jet ski however they are restricted by their perceived budget of $10 000 and feel their dream jet ski is out of their reach. The maximum the customer can afford is about $90 a week.

After discussing the customers budget the salesman proceeds to show the customer a well maintained and cared for second hand jet ski which has a price tag of $9997 Based on a financed sale over 3 years with an interest rate of 7.5% the customer could buy the jet ski for just over $70 a week.

After discussing the customers budget the salesman proceeds to show the customer a well maintained and cared for second hand jet ski which has a price tag of $9997 Based on a financed sale over 3 years with an interest rate of 7.5% the customer could buy the jet ski for just over $70 a week.

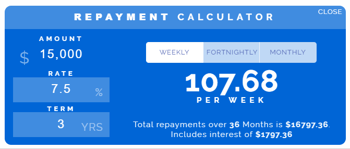

Upon hearing this news the customer is impressed with the low weekly payment and realizes that they have more purchasing power than first anticipated. Picking up on this the salesman then pitches the up-sell and introduces the idea that for just $35 more, or just over $100 a week, the customer could buy the new jet ski he's been dreaming of.

Upon hearing this news the customer is impressed with the low weekly payment and realizes that they have more purchasing power than first anticipated. Picking up on this the salesman then pitches the up-sell and introduces the idea that for just $35 more, or just over $100 a week, the customer could buy the new jet ski he's been dreaming of.

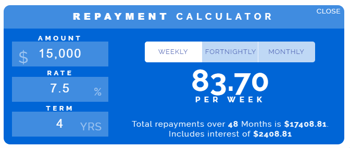

While excited by the potential of owning a new jet ski, the customer advises the salesman that $100 a week is just out of his reach, but the deals not dead yet. With a quick adjustment the salesman shows the customer how he can buy the new jet ski for just $12 a week more than the $70 a week for the second hand jet ski.

While excited by the potential of owning a new jet ski, the customer advises the salesman that $100 a week is just out of his reach, but the deals not dead yet. With a quick adjustment the salesman shows the customer how he can buy the new jet ski for just $12 a week more than the $70 a week for the second hand jet ski.

Bang. The customer, both shocked and excited, agrees to the deal and the application for finance is made. If approved, the salesman just increased the sale by 50%.

Obviously the salesman just extended the term of the loan from 3 years to 4, but this is the benefit of finance. With finance your ability to provide customers with a range of options that fit within their budget helps you close more sales.

Consumer financing offers a better customer experience

The jet ski sales example above leads into the next benefit of offering finance, providing a better customer experience.

In today's super competitive marketplace customer experience has become a top priority for businesses and 2020 will be no different.

According to a Walker study customer experience will overtake price and product as the key brand differentiator by the end of 2020.

Given this, your businesses ability to not only meet the increasing demands of consumers for finance options, but also provide them with streamlined, easily accessible finance solutions, with fast approvals, will be critical to providing a great customer experience.

More and more customers are basing their loyalty on the service they receive rather than price or product. If you business cannot keep up with their increasing demands and expectations, one of which is the availability of point-of-sale finance options, you're going to lose customers. In contrast, if you offer financing and can deliver a great customer outcome and experience, this is going to lead to business growth through word of mouth referral.

Consumer financing attracts more customers

Offering customer finance is going to make you more competitive and help you attract more customers. Providing finance shows your customer that you're a more sophisticated merchant and this, of itself, is a known attractor.

With consumer financing your ability to package high ticket products and or services into nice, affordable weekly or monthly payments, offer a range of finance options and provide customer access to a large pool of lenders are all very inviting sales propositions for your customers. This is particularly relevant if your competitor down the street isn't offering finance. By default you're going to automatically be the better option.

Consumer financing Improves cash flow

Arguably one of the biggest barriers for small businesses wishing to offer customer financing is the risk associated with providing your own loan program and the potential for negative cask flow from finance defaulters.

Arguably one of the biggest barriers for small businesses wishing to offer customer financing is the risk associated with providing your own loan program and the potential for negative cask flow from finance defaulters.

In short, slow payers and payment defaulters are the bane of small businesses. However by signing up as a referral partner with a third-party loan service provider like Ausloans, smaller businesses can enjoy the benefits of offering financing services without the headaches of managing timely customer repayments.

Benefits of merchant consumer financing for customers

Apart from the obvious benefit of being able to absorb the cost of a big ticket item purchase by breaking down the cost into small monthly repayments, consumers appreciate the convenience of fast, in-store or online finance approval.

If the idea of growing your business using financing and potentially increasing sales by 20% to 30% sounds exciting, read on as we share how you can start accelerating your business growth as an Ausloans finance partner.

Ausloans consumer financing programs for business

Now that we've outlined the benefits of offering finance services to your customer the question is how do you get started with offering finance?

Depending upon the nature and size of your business there are a number of ways to offer finance services, however for most SMEs the easiest and fastest way to start offering sales financing is by partnering with a 3rd party consumer financing service like Ausloans.

At Ausloans we offer a range of consumer financing program solutions, each tailored to meet the needs of businesses of different sizes.

Solution 1A: Ausloans referral partner program for SME's

Our referral partner program is designed for smaller businesses, who don't have an in-house finance broker, looking to offer consumer financing on goods and/or services over $8000.

Ideal for boutique dealerships, high ticket retailers, contractors and the like, our referral partner program partners your business with one of our expert brokers and gives your customers access to over 40 lenders with some of the most competitive rates in the country.

Read how we helped a Gold Coast swimming pool company close a $30 000 sale within 7 days of joining our referral partner program.

Solution 1B: Ausloans referral partner program for dealerships

Ideal for dealerships looking to expand their lender pool beyond the scope of their in-house financing capabilities, this solution gives your dealership instant access to a powerful financing alternative, that delivers lightning fast finance pre-approval and access to a pool of over 40 lenders.

Switching to Ausloans was extremely easy. We have been getting great customer feedback and keeping more deals. There is great communication and transparency and I would have no hesitation in recommending Morgan to friends, family and other businesses.

Tom Bennington

Used Car Floor Manager - Toyota

Solution 2: Ausloans Zink POS finance solution for Dealerships

Our panel has been proven time and time again to secure 4/10 deal minimum of the deals you throw in the bin - work that our a year - can grow quickly. - Rodney Michail CEO Ausloans

How to accelerate your business growth with Ausloans consumer financing referral partner program

If you're a small business who offers big ticket items as part of your product and / or service offering then the Ausloans consumer financing referral partner program may be the perfect solution for you.

It's free to partner with us and delivers a host of benefits to help both you and your customers.

Small Business Benefits

For small business the biggest benefit of becoming a member of our customer finance referral partner program is that your business gets all of the advantages of offering a professional and trusted customer finance solution without the hassle and expense of credit licensing.

Feel confident knowing that you have a highly skilled finance team working to provide you and your customers with an outstanding customer experience

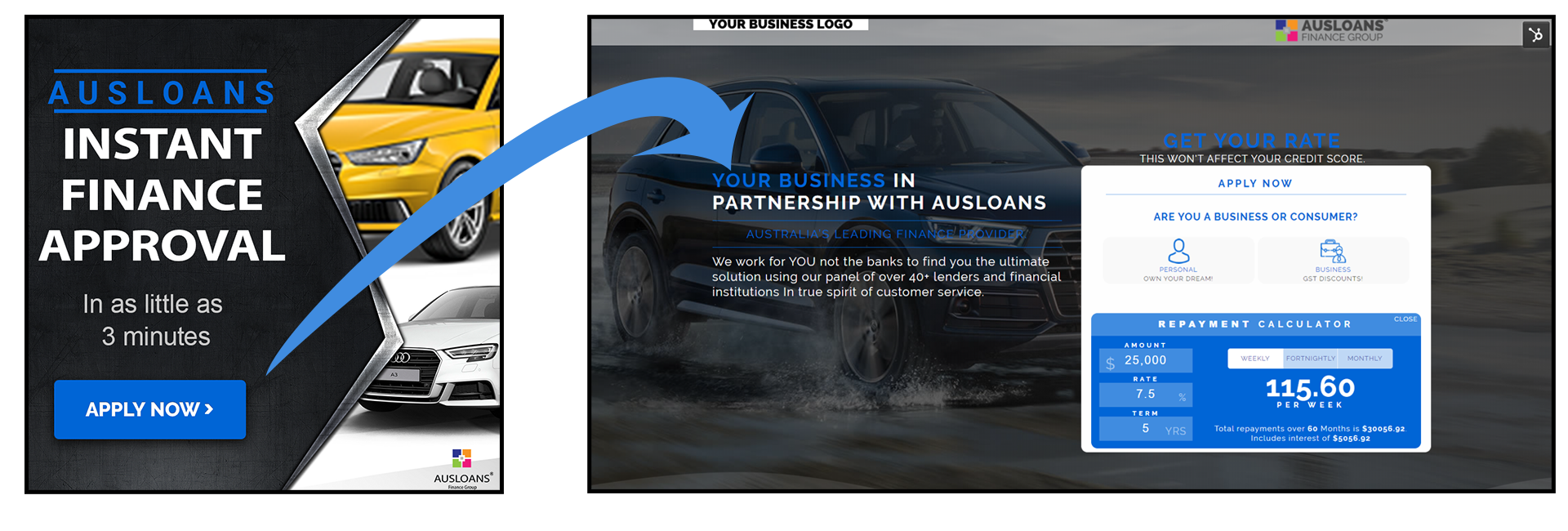

Simply direct your customers to apply for pre-approved finance through your Ausloans finance application landing page and our professional loans call center staff will work for you to deliver a rapid approval answer.

Customer benefits

For your customers, your Ausloans partnership provides instant access to fast finance pre-approval from a pool of over 40 lenders, direct from your business or website.

However it's not just the ability to offer customer financing through us that helps you accelerate your business growth.

When you partner with us we are committed to helping you grow and provide our partners with unparalleled free business support including:

- A bespoke finance application landing page for your customers

- Professionally designed free advertising and marketing resources,

- Marketing and financed sales training to help you grow

- Inclusion in our finance partner directory

- An Ausloans partner badge for your website

- Business spotlights and features in our consumer facing 1800 approved blog

- Spotlight promotion in our business and consumer newsletters

- and much more.

Got you interested? Ready to start offering customer finance and increasing sales? Click on the banner below to register and get started now.