Cars are expensive, and many people can’t afford to buy a new set of wheels outright. Thankfully, buyers have plenty of finance options available to them, both through car dealerships and non-bank lenders. So, whether you’re investing in a vehicle for personal or business use, there’s sure to be an option for you.

As well as standard dealership finance and leasing, you also have the option of taking out a loan with a so-called “balloon payment”. Basically, with a balloon payment, you can bring down your monthly loan repayments. However, you will have to pay more at the end of your loan term. As such, you must determine from the outset whether it’s the right option for you.

To help you make your decision, we’ve provided answers to the most frequently asked questions. From what a balloon car loan is and what happens at the end of the loan term to the various pros and cons, here’s everything you need to know.

Table of Contents

- What Is a balloon payment car loan?

- How does a balloon payment car loan work?

- How are balloon payments calculated?

- How do you set the amount of the balloon payment?

- Balloon payments and resale value

- What is the maximum balloon payment on a car?

- What’s the difference between a balloon payment and a residual payment?

- What happens at the end of the loan term?

- Can I refinance my balloon payment?

- Can I sell my car with a balloon payment?

- Can I trade in my car with a balloon payment?

- Can you pay off a balloon payment early?

- Can you extend a balloon payment?

- Is a balloon payment tax-deductible?

- Pros and cons of balloon payments

1. What Is a balloon payment car loan?

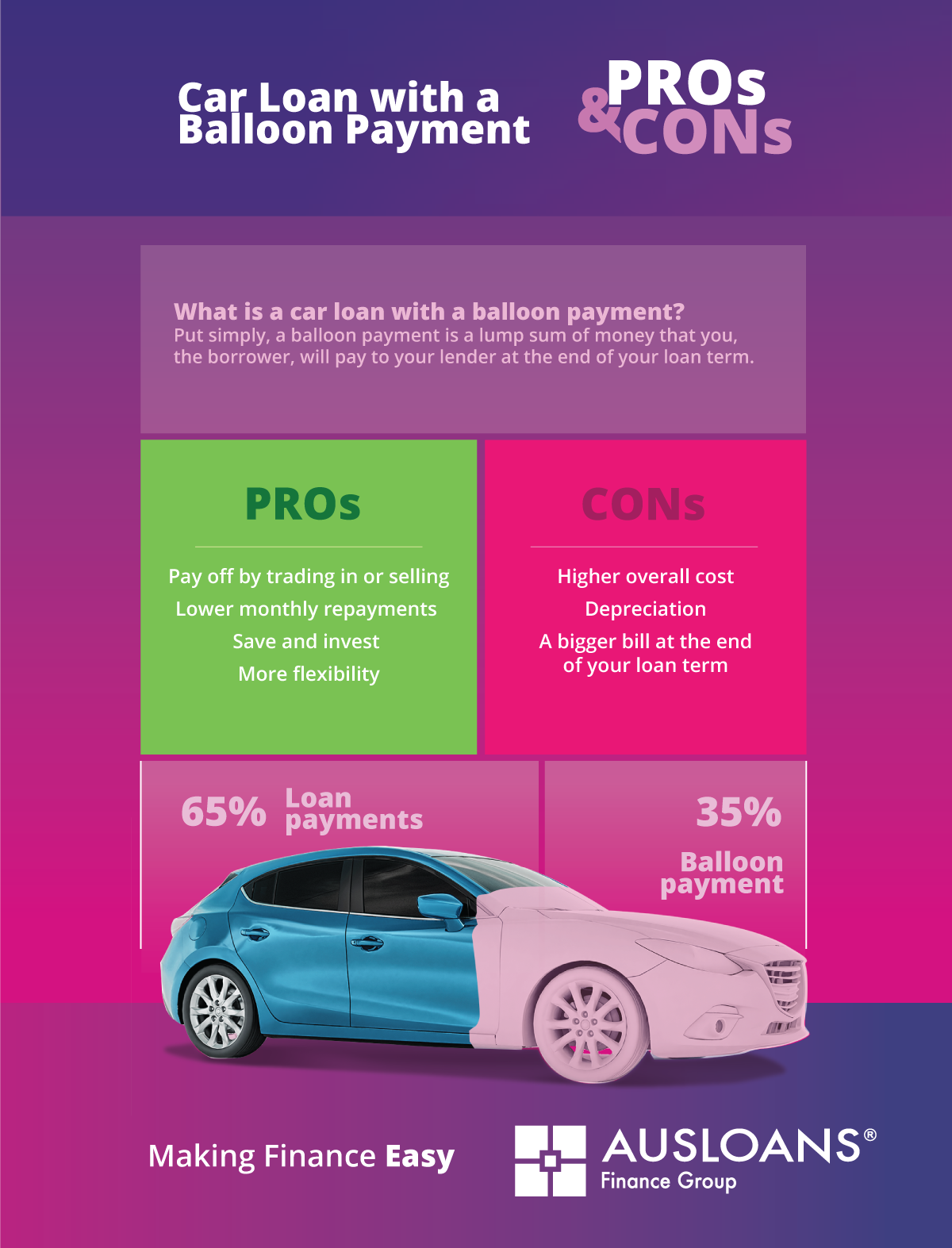

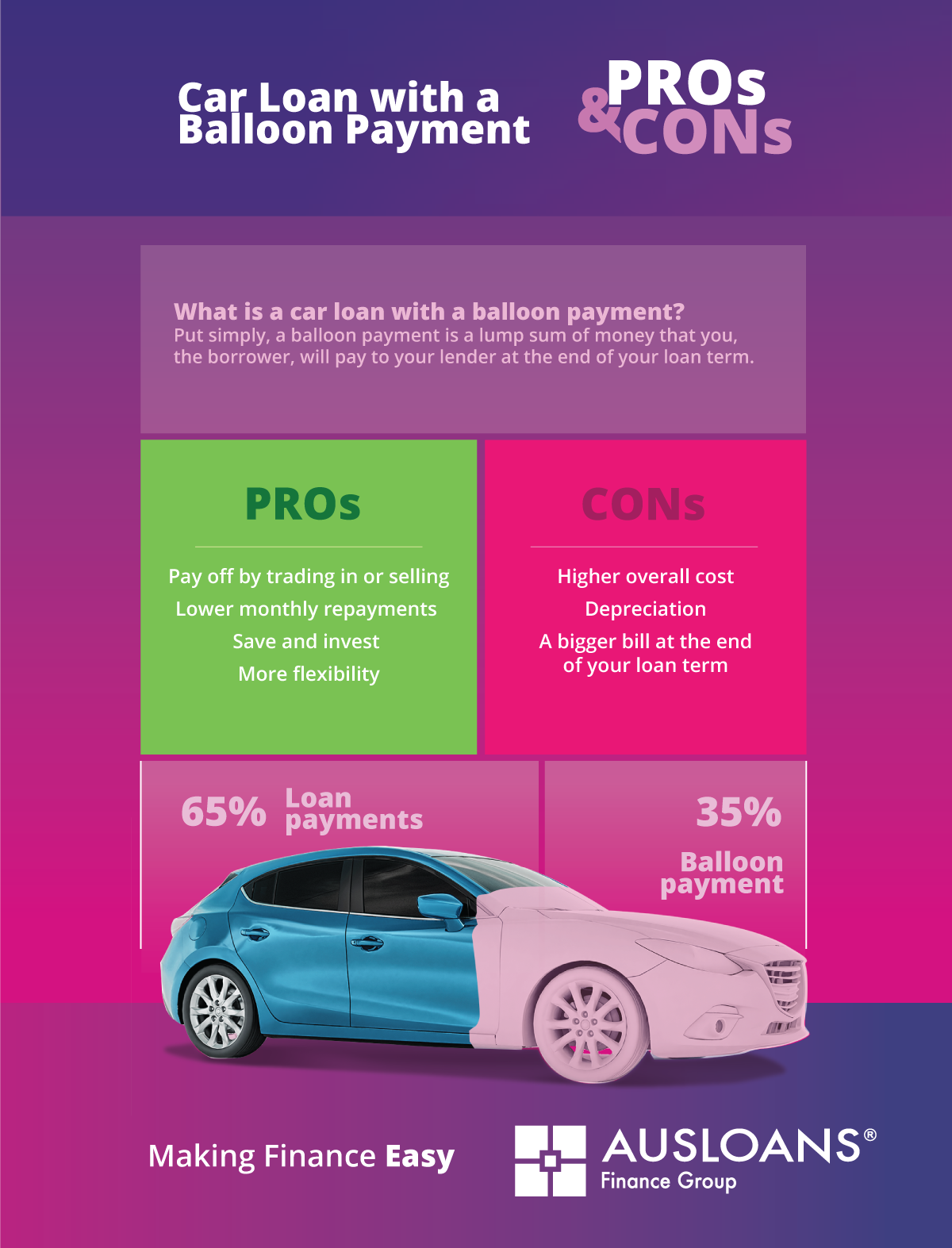

Put simply, a balloon payment is a lump sum of money that you, the borrower, will pay to your lender at the end of your loan term. You are generally required to cover your balloon payment following months of regular smaller payments. The caveat is that the final balloon payment, as the name suggests, will cost you far more.

You see, balloon loans do not amortise in the same way as standard loans. In other words, the costs of your repayments are not spread evenly. Rather, you are only expected to pay the interest on part of the loan principal until the very end. In return for these months of reduced repayments, you will eventually have to pay a much larger sum to cover the rest of the loan.

Balloon payments work for all sorts of different financial products, including mortgages, business loans, and, of course, car loans. They are ideal for people who want more financial flexibility each month. However, they require effective research and planning. Without a plan, people are all too often caught out when faced with their inflated final payment.

2. How does a balloon payment car loan work?

For the most part, a balloon payment car loan works much the same as most other loans. You and the lender will negotiate the loan, including the repayment term, interest rate, and more. But, in addition, you also have to agree on the cost of the balloon payment. This will typically be a percentage of the overall loan amount and is often capped by lenders. More on this later.

Some lenders can be quite strict when it comes to setting balloon car loan payment terms, including interest and price caps. Still, there’s always a chance that your lender will let you negotiate on this, too. Although, if your lender offers attractive enough terms, you shouldn’t need to. So, ensure you look for a loan that suits your circumstances.

3. How are balloon payments calculated?

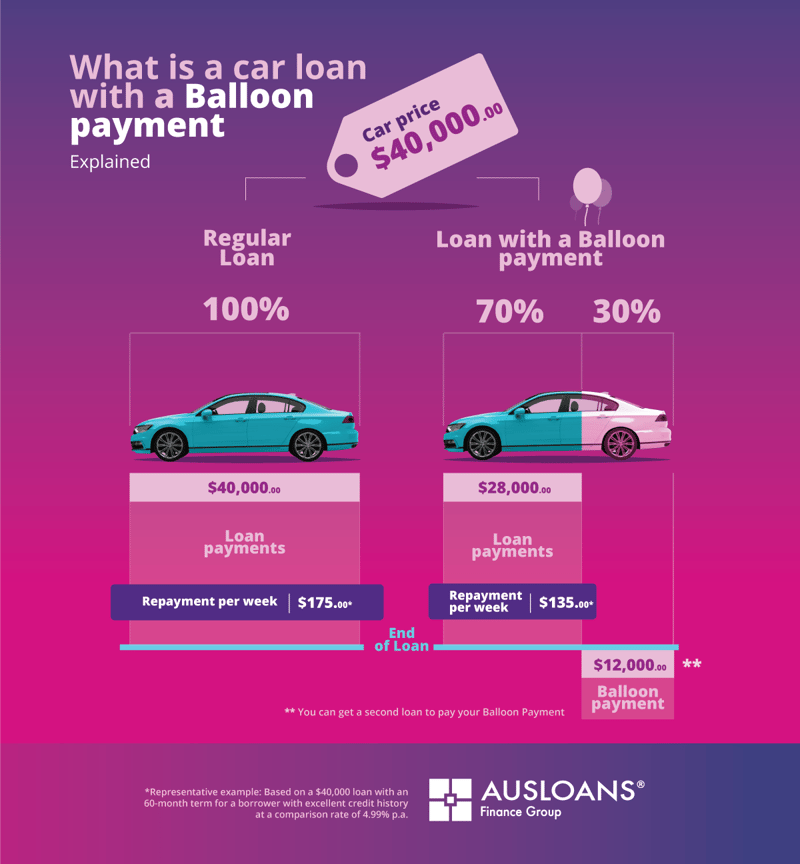

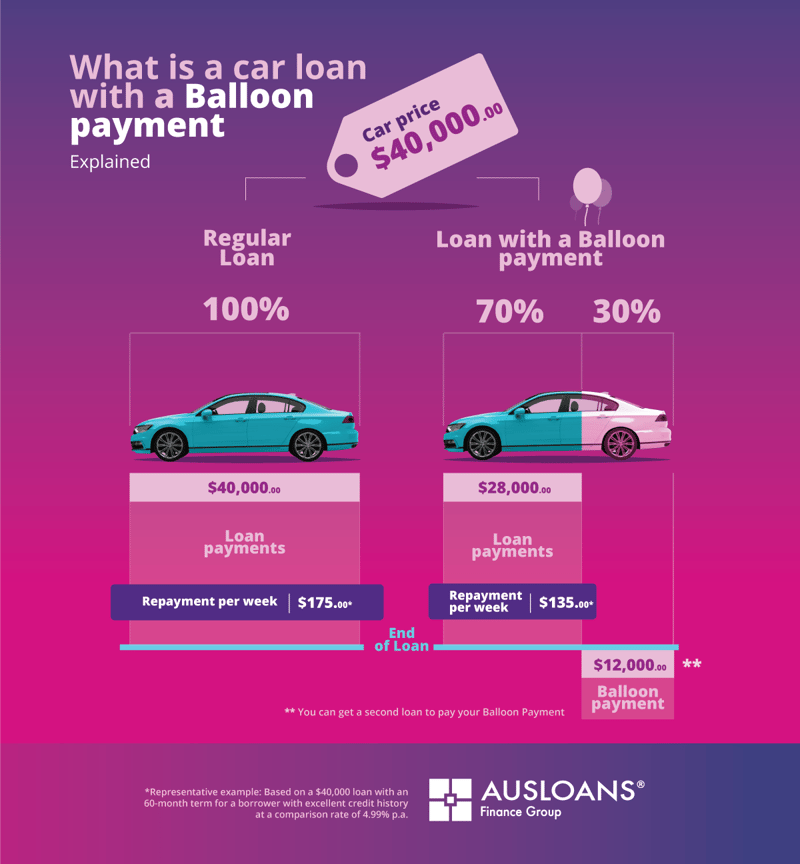

As mentioned above, auto loan balloon payments are calculated as a percentage of your overall loan amount. Your monthly repayments cover the remaining balance, which is why they end up being so much lower. To give you an idea of how balloon loans are calculated and what you can expect to pay, it’s worth looking at examples.

Say, for example, you took out a loan for a $40,000 car at 5% interest over five years. Without a balloon, the total amount payable would be $45,290 and your monthly repayments $754.85. But, with a 30% balloon of $12,000, those monthly repayments are reduced to $578.39. So, you would save $176.46 every single month.

The same applies if you want to buy a cheaper car with a higher balloon. Let’s say you wanted to purchase a $20,000 vehicle at 6% interest and pay it off over three years. Without a balloon, your total payment would be $21,903.79 with monthly repayments of $608.44. But, with a 50% balloon payment at the end of a car loan, you’d only have to pay $354.22 each month.

4. How do you set the amount of the balloon payment?

You decide how much you want your balloon payment to be. This will be set as a percentage that is then worked out as a lump sum, based on the car’s predicted resale value. Typically, balloon payments range from around 15% to 50% of the total value of the vehicle. Of course, you can also choose how much you would like to borrow and the loan term. However, the interest rate for any given balloon loan will be set by the lender. It is, therefore, a good idea to shop around for the best rates.

5. Balloon payments and resale value

Once you have decided what percentage of your loan you want your balloon payment to account for, the lender will work out the exact cost. To do so, they estimate the resale value of your car at the end of the loan term. This involves predicting how much the car will depreciate during your contract.

A few factors feed into the estimated resale value of a car. They include:

● The car’s make and model.

● What the car is used for.

● The car’s estimated yearly mileage.

● The age of the car.

● The length of your loan term.

Once the lender has predicted the car’s resale value, that figure will be written into your contract. So, even if their projection is inaccurate, you will only ever have to pay the amount set at the start.

6. What is the maximum balloon payment on a car?

Although balloon payments are all about paying off a significant chunk of your loan at the end, they’re usually capped. Generally speaking, most lenders will cap balloon payments at 50% of the total amount payable. So, if you’re looking to buy a $30,000 car, your balloon payment couldn’t be higher than $15,000.

Although balloon payments are all about paying off a significant chunk of your loan at the end, they’re usually capped. Generally speaking, most lenders will cap balloon payments at 50% of the total amount payable. So, if you’re looking to buy a $30,000 car, your balloon payment couldn’t be higher than $15,000.

The exact terms of the loan will, of course, vary depending on the lender. Further, many lenders set a lower maximum balloon payment on car loans for longer-term loans. As such, if your loan term is seven years, the balloon payment might be capped at 20% or 30%.

7. What’s the difference between a balloon payment and a residual payment?

You might also have heard of residual payments. A residual payment is very similar to a balloon payment in car loans and so they are often confused. However, there are some key differences you ought to be aware of.

You might also have heard of residual payments. A residual payment is very similar to a balloon payment in car loans and so they are often confused. However, there are some key differences you ought to be aware of.

As you know, a balloon payment is a specified lump sum that you agree to pay at the end of your car loan term. Doing so will reduce the regular monthly payments you have to make. Residual payments, on the other hand, are a broader category. The term refers to the final sum you’ll have to pay once depreciation has been taken into account.

Still, many people refer to the balloon payment left at the end of a loan term as the “residual value”. This isn’t necessarily incorrect. Both balloon and residual payments are about making a larger final payment to minimise monthly costs. However, the term “balloon payment” refers more specifically to the process defined above.

8. What happens at the end of the loan term?

As your loan term draws to an end, you need to work out what to do about your balloon payment. Of course, paying the balance is a lot of people’s first port of call. However, in some cases, that isn’t possible. Thankfully, there are a couple of options at your disposal if you find yourself in that position. Read on to find out more about each eventuality.

Pay the Balance

If you want to own your car outright, all you have to do is pay the final lump sum. To afford to do so, you must plan. It’s no good having lower regular repayments if you’re not sure how you’ll foot the final bill. So, take the reduced monthly costs as an opportunity to save or invest. Without a good pot, you’re less likely to have the money to pay off the last of your loan.

I can’t afford the balloon payment

When a person can’t afford to cover their balloon payment, they can either refinance their loan or sell the vehicle. Here’s what that would entail.

9. Can I refinance my balloon payment?

You might be able to take out another loan to cover the cost of your balloon payment. This would allow you to pay off the balloon in instalments. It’s a good option if you don’t have the cash to spare. However, in doing so, you extend your repayment period by between one and seven years.

Refinancing your final payment is likely to be at odds with the reasons you first wanted a balloon loan. Not to mention the fact that, by extending it, you’ll end up having to pay more on interest. And, finally, there’s no guarantee you’ll be approved for a new loan. So, refinancing certainly isn’t something you should rely on.

10. Can I sell my car with a balloon payment?

Alternatively, you could sell your vehicle if you no longer need it and can’t justify another loan. The money you get from selling the car can be used to fund your final loan payment. Just bear in mind that the car may no longer be worth what it was. In that case, it might not cover the cost of the balloon payment. This often happens if the car is damaged or depreciates for another reason.

11. Can I trade in my car with a balloon payment?

For some, selling their asset is a good way of ending their loan when they’re ready for a new car. In other words, it’s an ideal option for those hoping to invest in a new vehicle. It means they can apply for a new loan with little to no existing debt left to pay. Again, though, this is only the case if their current car hasn’t depreciated. Taking good care of the vehicle is, therefore, a must.

When trading in, aim to sell your current vehicle when its value is roughly the same as the balloon payment. If you do, there won’t be much difference left to pay. You may even end up with a positive cash balance which you can put towards your new car. This will allow you to take out a less costly loan with a lower balloon payment.

12. Can you pay off a balloon payment early?

There’s no hard and fast answer here. Some lenders don’t offer early repayment options at all. Others are far more flexible and, therefore, willing to let borrowers pay off their balloon payments early. Others may only do so if the borrower agrees to pay a penalty fee. After all, they’ll lose out on the interest from your monthly instalments if you back out early.

If you want to leave yourself open to all eventualities, check out the different lenders’ repayment policies before you apply. It’s worth opting for a lender that offers penalty-free early repayment, as long as their rates are competitive. If, however, your lender does charge a penalty fee, weigh up the pros and cons. You need to know, for example, how much you’ll save on interest against the repayment charge.

13. Can you extend a balloon payment?

As above, every lender approaches balloon payment extensions differently. While many allow borrowers to extend their loans for a few extra years without changing the loan terms, that’s not always the case. Some of them will hike the interest rate if you want an extension. Or, they might ask for a partial paydown, which is sort of like a deposit. Finally, other lenders will outright refuse to extend an agreed balloon loan term.

14. Is a balloon payment tax-deductible?

Many people use their cars for work or business purposes. If that’s the case for you, you probably already know that you can claim tax deductions on some of your repayments. This includes the interest charged on your car loan. Unfortunately, though, balloon payments are not tax-deductible, even if the interest on the loan is.

This is because tax deductions only apply to the interest of a business-related asset. Since the balloon payment is based on the cost of the asset itself, you cannot claim it as a tax rebate. However, you can claim the interest on the monthly repayments. And, since you pay an increased amount of interest each month, balloon loans are often beneficial come tax season.

15. Pros and cons of balloon payments

Balloon payments are better for some people than others. For the most part, then, the pros and cons of balloon payments depend on who you are and your circumstances. However, things like your long-term planning skills and organisation also play a part.

Generally speaking, balloon payments are well-suited to sole traders and small business owners. This is because balloon loans help to minimise monthly outgoings. As a result, entrepreneurs have more cash to play with in the short term. Ideally, they will use that cash to generate revenue that can be put towards the balloon payment.

That’s not to say that balloon payments don’t work well for others. They can work very well for all sorts of different consumers. At the end of the day, if a person is sure they can pay the final instalment, balloon payments are well worth considering. However, if you’re still unsure, the below pros and cons should help you make up your mind.

Pro: Lower monthly repayments

By now, you should already know that a balloon loan entails lower monthly repayments. This is because the final instalment or “balloon” is set at a much larger percentage of your principal amount. Still, it’s worth discussing exactly why these lower monthly repayments are often so advantageous.

For one thing, they make car buying far more accessible. So, startup business owners and cash-strapped families are more likely to be able to afford one. For another, they give borrowers the time they need to save up for their balloon payment. As such, it’s a great way of buying a car without ever going over budget.

Pro: save and invest

Lower monthly repayments help to free up cash. While, for some, this might be best spent in the family budget, for others it’s a great opportunity to save. So, work out the difference between what you would be paying without a balloon payment and what you do pay. Then, put some or all of that into your savings each month.

Or, you could put that money into investments. So, whether you’re in business or dabble in stocks on the side, you could earn more with the money you save.

Pro: more flexibility

Another advantage is balloon payments’ flexibility. While lenders work out the exact cost, it is the buyer who decides what percentage of the principal they want their balloon payment to be. Typically, the only limits are that it must be between 10% and 50%. Other than that, borrowers can determine how much they want to pay at the end of their loan term. In doing so, they take control of the cost of any preceding repayments.

Pro: Pay off by trading in or selling

You also have flexibility when you reach the end of your balloon loan. In other words, you aren’t stuck with paying that inflated final instalment in cash. Sometimes, doing so simply isn’t possible. Other times, it isn’t the most desirable course of action. In any case, you have the option of trading your car or selling it to cover that large lump sum.

When you trade-in or sell your vehicle, you can use the money to pay for the balloon. In some instances, the value of the car might not be quite enough to cover the costs. Still, with little to no existing debt left to pay, you then have the option to take out another loan. So, you can finance a new, more modern car.

Con: Higher overall cost

Despite the many benefits, there are drawbacks to balloon payment car loans. The major one is that they cost more in the long run. This is because the balloon payment inflates the amount of interest you pay throughout the loan. That’s why many lenders won’t grant higher balloon payments for longer-term loans. In the end, it’s likely to cost you more, which could impact your ability to cover the balloon.

As such, balloon loans are best-suited to people on a higher income. For those who aren’t sure how they’ll fund the final balloon payment, a shorter-term balloon loan is recommended. That is unless they plan to pay by selling their car, trading it in, or refinancing the loan.

Con: A bigger bill at the end of your loan term

This one sounds obvious, but plenty of people get caught out by the big bill at the end of their loan term. That’s why it’s so important to have a plan for how you’ll cover the balloon payment at the outset. Otherwise, you could find yourself without the means to pay when the time comes. If you want to keep the car you’ve got, you must have the money when it’s needed.

Of course, you do have the option of refinancing the balloon. But, just remember that there’s no way of knowing whether you’ll be approved or not. Therefore, the best course of action is to save as you go. If you don’t, it’s all too easy to forget about the balloon payment looming at the end of your loan.

Con: Depreciation

With any asset, you need to take into account depreciation. This is especially true of those bought with a balloon loan. You see, the more they depreciate, the more likely you’ll end up paying more than they’re worth. Cars that are bought with longer-term loans and those driven frequently are particularly high-risk.

It’s bad enough coughing up for a balloon payment when the car is worth less than predicted. It’s even worse if you planned to sell the car to cover the cost. So just bear in mind the risk before you sign any paperwork. And, of course, aim to look after your car as best you can. This will help you retain the car’s resale value.

All you need to know about balloon payment car loans

If you were wondering “what is a balloon payment on a car loan?”, hopefully, this guide has given you all the information you need. From how they work to when and why they’re advantageous, we’ve included answers to all the most important questions.

By now, then, you should understand that balloon payment car loans can be beneficial for certain types of people. They keep monthly repayments low and help borrowers free up cash. However, they also carry inherent risks and, as such, are not for everyone. So, you must understand what you’re signing up for and plan accordingly. There’s just no point in applying for a balloon loan if you don’t know how you’ll pay in the end.

-1.png?width=250&height=84&name=MicrosoftTeams-image%20(29)-1.png)

/staff%20profile%20photos/Chris.jpg)

Although balloon payments are all about paying off a significant chunk of your loan at the end, they’re usually capped. Generally speaking, most lenders will cap balloon payments at 50% of the total amount payable. So, if you’re looking to buy a $30,000 car, your balloon payment couldn’t be higher than $15,000.

Although balloon payments are all about paying off a significant chunk of your loan at the end, they’re usually capped. Generally speaking, most lenders will cap balloon payments at 50% of the total amount payable. So, if you’re looking to buy a $30,000 car, your balloon payment couldn’t be higher than $15,000.  You might also have heard of residual payments. A residual payment is very similar to a balloon payment in

You might also have heard of residual payments. A residual payment is very similar to a balloon payment in

Comments (2)