Australia has enjoyed relatively low-interest rates over the last few years. However, since May 2022, the RBA Cash Rate increased from 0.35% to currently 4.10%. How will this significant rise affect your car loan? When is the best time to secure an auto loan? We'll answer all your questions and more.

What Is a Good Car Interest Rate?

Your car interest rate depends on your specific situation and the lender you borrow funds from. The lower the interest rate, the less money you pay throughout your loan. And, of course, the less your car costs.

Many factors affect interest rates (which we'll cover in more detail later). However, generally speaking, if you have a credit score of 700 or above and a good application, the interest rate for a new car is around 6.60%. What you consider a 'good interest rate' depends entirely on your situation. Speak to a finance broker about car loan options to find a lower interest rate.

Why Do Interest Rates Matter?

Firstly, let's go over the basics. What do interest rates mean, and why should you care? When you borrow money from a lender or bank, they will charge you interest on the outstanding balance until you fully repay the loan.

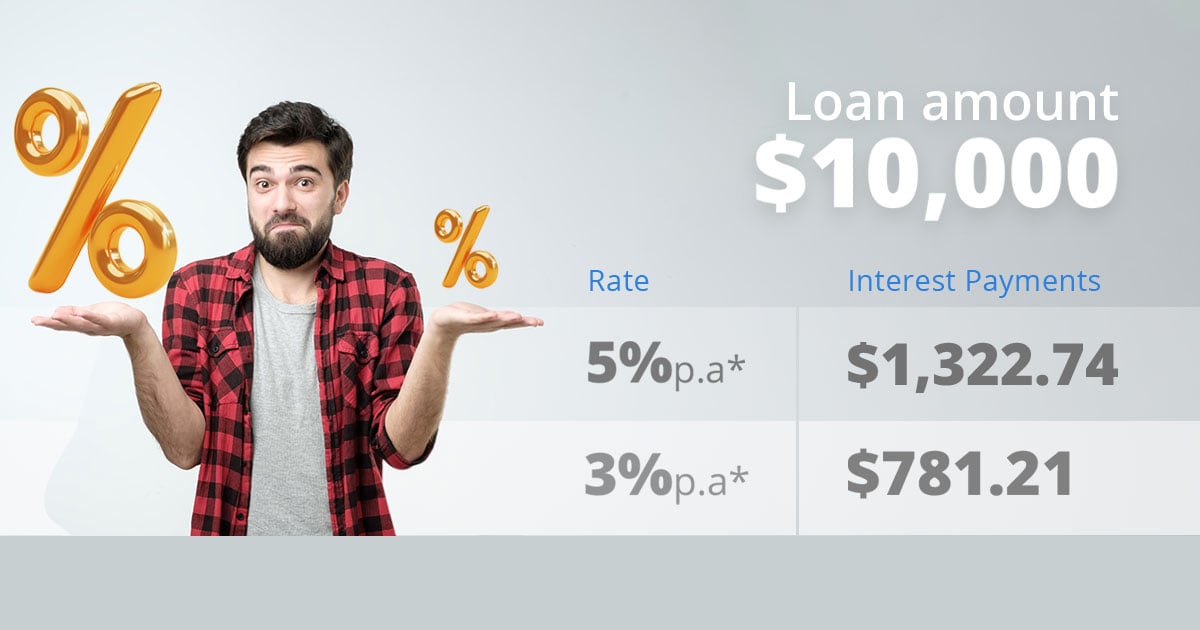

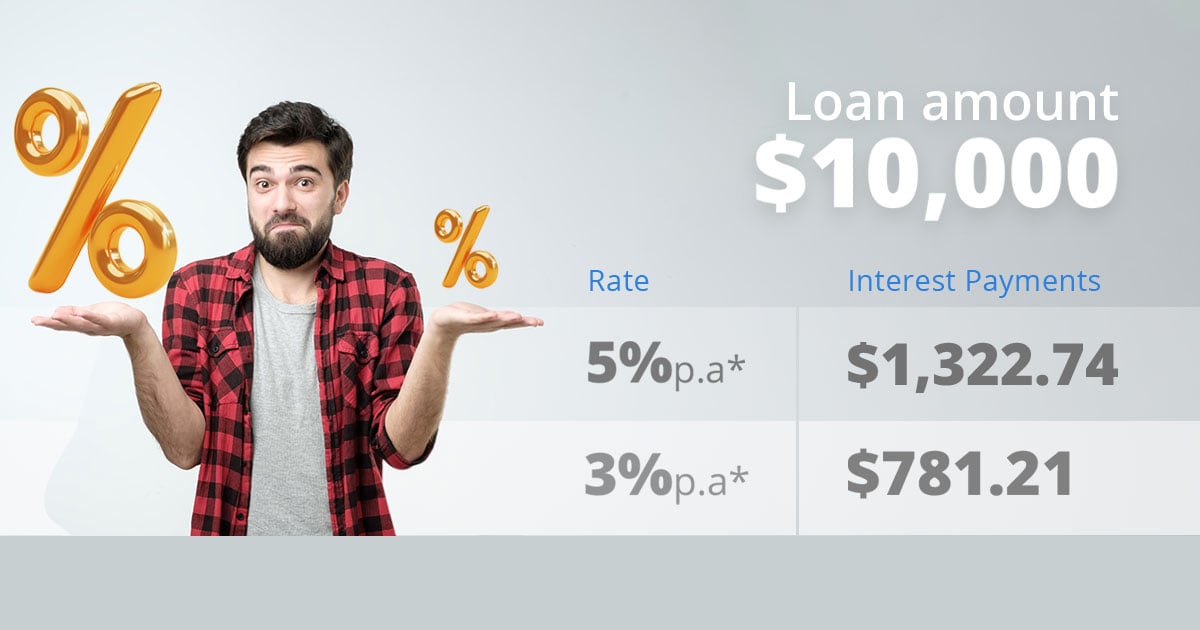

The interest rate is the percentage at which they charge you interest. For instance, if you were to borrow $10,000 with an interest rate of 5% over five years, your total loan interest payments would be $1,322.74. However, if you have an interest rate of 3%, you'll only pay $781.21. Even a 0.5% difference can significantly impact your car loan repayments.

Why Are Car Loan Interest Rates Going Up?

The RBA sets the Cash rate at the beginning of each month. The cash rate informs the interest rates banks and lenders offer you on loans. From November 2020 to April 2022, the RBA's Cash Rate remained at 0.10%. Such a low-interest rate encouraged Aussies to take out auto loans for their new car purchases. However, as of June 2023, the cash rate is now at 4.10%.

As a result, car loan lenders and banks will raise their interest rates accordingly.

So, why have interest rates gone up? The answer is complex—many factors impact the RBA's Cash Rate. Rate increases are a reflection of economic conditions and the last few years have been economically chaotic. The global pandemic stalled many industries and halted the economy. As a result, interest rates went down to encourage spending. Inflation is increasing, and the RBA must limit the interest rate to prevent excessive inflation. If inflation is high, the RBA might raise rates to try and control it.

Generally speaking, in weaker economies, interest rates are lower. In more robust economies, interest rates are higher. As our economy rebuilds, interest rates are likely to keep increasing. Therefore, now may be the best time to secure your car loan.

Factors That Impact Your Interest Rate

You can't do much about external factors impacting the interest rate. Other than timing your car loan application, the RBA'sCash Rate is beyond your control. However, you can do something about the personal factors that influence the interest rate on your car loan. Here are a few aspects that might affect your interest rate.

- Credit score: Strong credit scores suggest that you are reliable and low-risk, meaning lower interest rates. Conversely, lower credit scores often mean higher interest rates.

- Down payment: The larger your deposit, the less money you need to borrow. Therefore, this indicates you are a low-risk borrower and may mean a lower interest rate. Smaller deposits may cause lenders to charge higher rates.

- Loan term: Longer loan terms tend to have higher interest rates than shorter ones.

- Lender: Each lender sets its own interest rate. Dealerships tend to advertise low-interest rates but charge higher fees elsewhere, which may be more expensive. It's best to approach a car loan broker to find the best lender for your situation.

- New or used car: Rates on used car loans tend to be higher than on new cars as they are unsecured loans—meaning that the lender has nothing to guarantee they make their money back should you default on your payments.

How Will Increasing Interest Rates Affect Car Loan Repayments?

So, interest rates are going up. What does this mean for you? You don't need to worry if you already have a car loan at a fixed rate. Rising interest rates do not impact fixed-rate loans. If you have a variable rate loan, you may see your monthly repayments increase in line with the RBA's Cash Rate.

What does it mean for you if you're considering taking out a loan?

Buying a car now is more expensive than it would have been in April 2022. With higher interest rates, you will pay more for your auto loan. However, rather than thinking of missed opportunities, it's best to look ahead. According to ANZ's most recent predictions, rate cuts may not be likely until November 2024. CommBank, NAB and Westpac also states that the RBA will make one further rise of 25 basis points in either July or August , bringing the cash rate to a peak of 4.35%. Therefore, to secure the cheapest car loan available now is the best time to lock in a fixed-rate car loan.

What Do Higher Interest Rates Mean for Used Cars?

As we mentioned, used cars often have higher interest rates. This is because lenders typically only offer unsecured car loans for used vehicles.

A secured car loan is when you offer your vehicle as collateral. The lender has the legal right to claim your car if you miss your payments. With an unsecured loan, the lender has no protection. Therefore, they tend to raise their interest rates, so they don't miss out.

While a used car may be cheaper, the interest payments may cost more. Speak to a car loan broker about the differences between used and new car loans and how it impacts your interest rate.

Tips on How to Pay Less Interest

Here are some tips to secure a lower interest rate on your next car loan.

1. Shop Around

The first lender you find won't offer you the best rates available. Shop around to experience the market. Understand what different lenders are willing to offer and negotiate a better deal. Speak to a car loan broker; they'll do the hard work and shop around on your behalf.

2. Time Your Purchase

As we mentioned, now is the best time to secure a fixed-interest car loan. If you wait a few months before purchasing your vehicle, interest rates may go up again. One of the best ways to score a lower interest rate is to watch the market and time your purchase.

3. Opt for a Shorter Term

Consider your budget; can you swing higher monthly payments? The shorter your loan term, the less interest you pay over the loan's lifetime.

4. Refinance

If you already have a car loan and want to lower your interest rate, consider refinancing to a new lender or negotiating with your current lender. After making on-time payments for a few months, your lender might reconsider your reliability and lower your interest rates.

5. Boost Your Credit Score

A good credit score suggests that you are a low-risk borrower. If you have a bad credit score, you can apply for bad credit loans. However, you should consider boosting your credit score if you want a lower interest rate. Even a tiny change in your interest rate could make a significant difference throughout your loan.

To improve your credit score, ensure you make on-time repayments, balance your credit utilisation, and pay outstanding debts.

6. Buy a Less Expensive Car

Finally, the less expensive your car, the smaller your loan. Therefore, you'll pay less interest. While your interest rate might remain high, the actual amount of money you'll pay will be more affordable. So, if you have your eye on an expensive vehicle that is out of your budget, consider lowering your expectations. Maybe next time you'll purchase the car of your dreams.

Fixed Car Loan Interest Rates

Fixed car loan interest rates are a good option during fluctuating markets. When the interest rates are low, it's best to secure a car loan with a fixed rate so you can enjoy the low rates for the next five years. Variable-interest loans are suitable when interest rates are high. Therefore, your car loan interest payments will go down when the rate drops again.

As interest rates rise, consider securing your fixed loan with low rates today.

Why You Should Lock In Your Rate Today

No one can predict with 100% certainty how interest rates will behave in the next few months or years. However, as our economy rebuilds, we expect the interest rates to continue to increase. If you're considering buying a new or used car, now might be the best time.

Seize the opportunity to apply for a fixed-rate loan and enjoy low-interest payments throughout your loan. Don't miss out on the opportunity to save money, before it's too late.

-1.png?width=250&height=84&name=MicrosoftTeams-image%20(29)-1.png)

No Comments Yet

Let us know what you think